There is no such thing as a fastened minimal financial institution stability for UK vacationer visa, however you will need to show ample funds to cowl day-after-day of your journey. The Dwelling Workplace caseworker checks that the cash is genuinely accessible and matches your deliberate itinerary.

- Function: present you possibly can pay for journey, lodging, day by day prices and the journey residence with out working or utilizing public funds

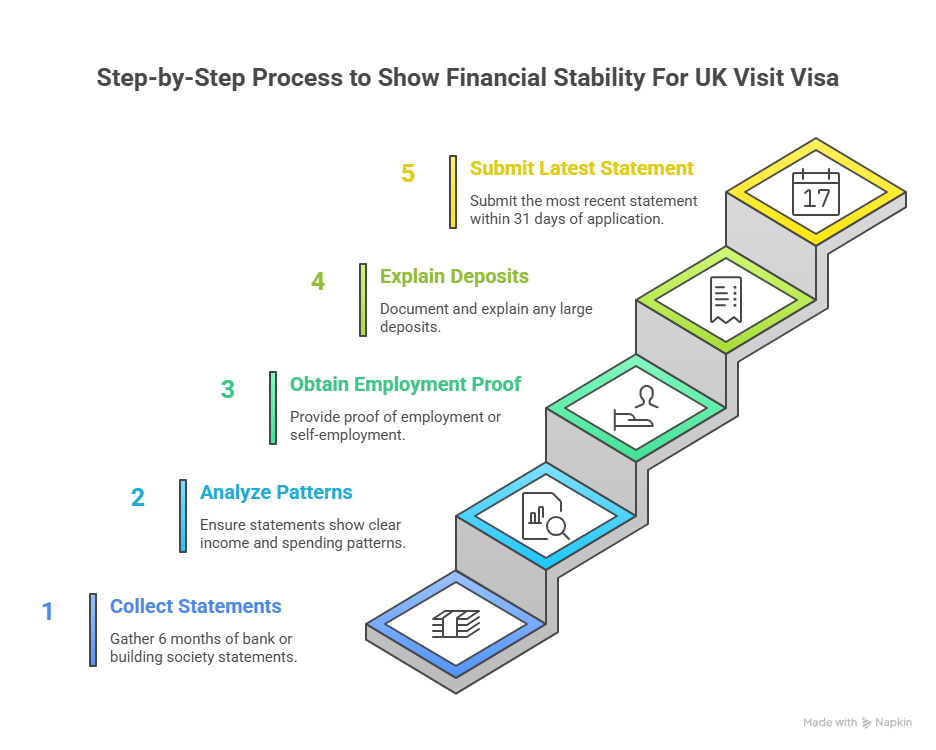

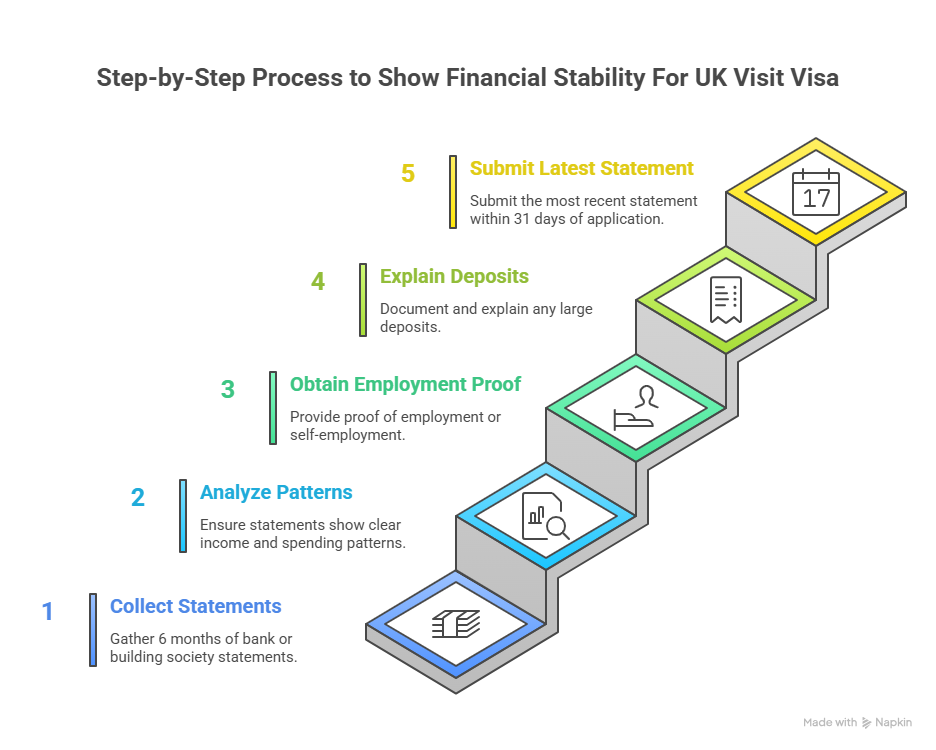

- 28 Day Rule: the closing stability should keep the identical for 28 consecutive days ending not more than 31 days earlier than you apply

- 6 Month Statements: UK customer visa requires a monetary proof of official financial institution information protecting at the very least six months so officers can see common earnings and regular spending

- Sponsor Possibility: a good friend or relative might pledge help, but they have to additionally present six months of their very own statements and signal a letter promising to cowl your prices

- Funds Warning: giant unexplained credit near the appliance date are handled as borrowed cash and stay the highest cause for refusal

Disclaimer: The data on this weblog is correct as of its publication date. Any updates after that date usually are not mirrored right here.

When making use of for a UK Go to Visa, you’ll need to point out that you’ve ample funds to help your self throughout your keep. Earlier than you apply, ensure you have all of your supporting papers prepared. You possibly can undergo our UK Go to Visa paperwork guidelines to make sure you’ve included each necessary doc, out of your financial institution statements to your journey historical past, earlier than submission.

The issue is that UK Visas and Immigration (UKVI) clarify precisely how a lot is required, leaving many Go to Visa candidates understandably confused. This text goals to clear up any confusion and can clarify how a lot financial institution stability you’ll need to fulfill the Go to Visa necessities.

If you’re about to make a Go to Visa software to return to the UK, you’ll need to point out that you’ve sufficient cash to cowl your time right here. This is among the checks to confirm that candidates are real guests. You need to present proof of funds for UK vacationer visa functions to point out which you can help your self throughout your keep within the UK.

Enough funds should cowl:

- Journey: return or onward tickets plus any inside transport

- Lodging: resort, visitor home or personal keep for each night time

- Meals: day by day meals and drinks for you and anybody travelling with you

- Dependants: prices for partner, companion or kids listed on the appliance

- Deliberate actions: personal medical remedy, pre-booked excursions, conferences or occasions

Appendix V of the UK immigration guidelines states that candidates should fulfill the choice maker that they’re real guests, which implies the applicant: “should have ample funds to cowl all affordable prices in relation to their go to with out working or accessing public funds, together with the price of the return or onward journey, any prices referring to their dependants, and the price of deliberate actions similar to personal medical remedy. The applicant should present that any funds they depend on are held in a monetary establishment permitted underneath FIN 2.1 in Appendix Finance”.

Understanding the UK Customer Visa necessities is important earlier than you start your software course of.

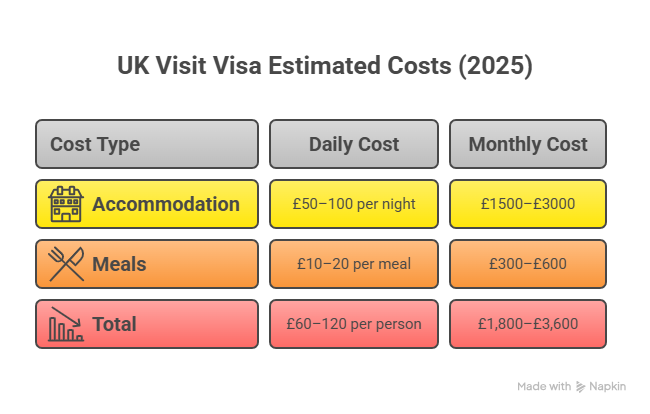

Sadly, UK Visas and Immigration (UKVI) doesn’t specify the precise amount of cash that it’s essential to have in your checking account for a UK Go to Visa. What issues is which you can exhibit that the quantity you’ve gotten is sufficient to cowl all of your bills throughout your keep within the UK with out counting on public funds. For candidates questioning in regards to the minimal financial institution stability for UK vacationer visa, the reply depends upon your journey length and deliberate actions. This consists of:

This consists of:

- Lodging (e.g. resort, B&B, Airbnb, residence)

- Residing prices (e.g. meals)

- Journey bills (flights, practice, visa)

Pattern Funds Information:

| Days | Lodging £80/night time | Meals £30/day | Transport £20/day | Misc £20/day | Whole |

| 7 | 560 | 210 | 140 | 140 | £1,050 |

| 15 | 1,200 | 450 | 300 | 300 | £2,250 |

| 30 | 2,400 | 900 | 600 | 600 | £4,500 |

Whereas UKVI doesn’t specify an quantity that you will need to have to use for a Go to Visa, we advocate that you’ve gotten at the very least the next quantities:

With regards to journey (e.g. practice journey across the UK), just be sure you have researched the price of your journey/s and that you’ve sufficient in your financial institution to cowl them.

If you’re making use of from India, Pakistan or Nigeria, caseworkers see 1000’s of information each month. Displaying a stability that matches the desk above plus regular wage credit is the best approach to go the funds take a look at. Indian candidates ought to word that the minimal financial institution stability for UK vacationer visa from India ought to align with these really useful quantities to keep away from refusal.

A common guideline is to have at least £1,800 to £3,600 accessible for every month you propose to remain within the UK. This can rely in your deliberate actions, lodging prices, and private spending habits.

The 28-day rule means the cash you depend on should sit in your checking account for 28 consecutive days earlier than you apply. Throughout this era, the stability mustn’t ever drop under the quantity you want on your journey, even for at some point. The closing stability date in your most up-to-date assertion have to be inside 31 days of the net software date.

Entry Clearance Officers depend every day backwards from that closing stability to verify the total 28-day historical past, so give your self a transparent buffer and apply as quickly because the 28-day window is full. This rule applies to all candidates checking the minimal financial institution stability for UK vacationer visa necessities.

UK Visas and Immigration doesn’t publish a set rupee or naira determine, however expertise from latest selections in 2025 exhibits that officers search for roughly £100 per day plus the price of your flight. The desk under turns that guideline into native forex so you possibly can choose the stability you need to present.

| Journey size | UK value information | India (₹) | Pakistan (PKR) | Nigeria (₦) |

| 7 days | £900 | 1.9 – 2.1 lakh | 6.0 – 6.5 lakh | 1.4 – 1.5 million |

| 10 days | £1 200 | 2.5 – 2.7 lakh | 8.0 – 8.5 lakh | 1.9 – 2.0 million |

| 30 days | £3 300 | 6.9 – 7.2 lakh | 22 – 23 lakh | 5.2 – 5.4 million |

Preserve the cash in your account for the total 28-day rule and add a stamped financial institution assertion that exhibits common wage credit. The minimal financial institution stability for UK vacationer visa proven within the desk above represents the baseline quantity that Entry Clearance Officers anticipate to see. Candidates from India, Pakistan and Nigeria sit within the highest-volume caseload, so a transparent stability that matches the desk above is the best approach to keep away from a refusal.

If you happen to’re making use of from India, the steps, charges, and timelines can differ barely. Comply with our up to date walkthrough on the UK Vacationer Visa from India software course of to know how you can apply, e book your biometrics, and add your paperwork appropriately.

Sure, underneath the UK Immigration guidelines, somebody (i.e. a sponsor) within the UK can present your journey, upkeep or lodging. Many individuals ask how a lot cash do I have to sponsor a customer to the UK, and the reply depends upon the customer’s journey size and deliberate bills. To take action, you’ll need to offer proof displaying:

- What help is being offered to you, and whether or not it extends to a dependent member of the family (e.g. your companion or youngster)

- How this help is being offered

- The individual sponsoring you has ample funds to adequately help themselves and their dependents

- The connection between you and the sponsor (e.g. if they’re your member of the family or your employer) and

- The individual sponsoring you is legally within the UK (e.g. EUSS Settled Standing, ILR doc or British passport).

Sponsor Proof Pack to Put together

1. Funds

- Six months of authentic financial institution statements within the sponsor’s identify

- Signed and dated letter that states the precise amount of cash supplied, what it’ll pay for (journey, lodging, day by day prices) and whether or not the reward is repayable

2. Relationship

- Delivery or marriage certificates if household

- Employment contract or HR letter if the sponsor is your employer

- Easy signed word explaining the way you met and the way typically you communicate if the hyperlink is friendship

3. Authorized Standing within the UK

- British passport photocopy (photograph web page), or

- Present BRP back and front, or

- EUSS share code printed inside 30 days, or

- ILR letter from the Dwelling Workplace

When figuring out how a lot cash do I have to sponsor a customer to the UK, sponsors ought to exhibit the identical stage of funds proven within the customer’s funds information, plus proof of their very own monetary stability.

When submitting your visa software, you’ll need to offer financial institution statements protecting at the very least the final 6 months. In case your account is newly opened, you will need to nonetheless give 6 months of information from any earlier account or present a letter from the financial institution that confirms the opening date and stability historical past. Each web page have to be stamped by the financial institution or downloaded as a safe digital assertion that may be verified on-line.

Financial institution Assertion Format for UK Customer Visa

Statements could be printed on official financial institution letterhead or downloaded as licensed PDF copies. Guarantee all pages are legible and, if submitted digitally, are stamped or verified by your financial institution.

These statements ought to clearly present your earnings outgoings and exhibit your total monetary stability. It is very important present monetary paperwork proving that you’ve ample funds accessible and that you’ve entry to the funds. Understanding what constitutes a suitable financial institution assertion for UK visa functions will make it easier to put together the precise documentation.

Acceptable proof might embrace:

- Financial institution statements displaying the place the cash got here from

- Constructing society books displaying the origin of the funds held, and

- Proof of earnings (e.g. a letter out of your employer confirming employment particulars, together with your begin date of employment, wage, position, and firm contact particulars.

Keep in mind that the consistency and regularity of deposits into your account are as vital because the stability itself. These will replicate your real monetary state of affairs and functionality to help your self throughout your go to to the UK. A suitable financial institution assertion for UK visa will present regular earnings, common transactions, and ample funds maintained over the required interval.

Guidelines for Monetary Proof

Along with the above, there are sure guidelines on the dates of economic proof that you will need to adhere to:

- Essentially the most just lately dated piece of economic proof have to be dated inside 31 days earlier than the date of software.

- The size of time for which funds are held can be calculated by counting again from the date of the closing stability on probably the most just lately dated piece of economic proof.

- The monetary proof offered should cowl the entire time period for which the funds have to be held.

Sure. Entry Clearance Officers (ECOs) run each assertion by means of a three-step verify:

- Financial institution contact: The Threat and Verification Unit emails or telephones your department to substantiate the account exists, the stability is appropriate and the assertion is real.

- Sample evaluation: Software program scans for round-number deposits, sudden jumps or similar quantities that recommend the cash was parked for the visa .

- Digital forensics: Fonts, spacing and PDF metadata are in contrast with the financial institution’s recognized templates. Any mismatch flags the doc for guide overview.

If the assertion can’t be confirmed, or if tampering is discovered, the appliance is refused, and the applicant receives a 10-year ban for deception. The UK go to visa funds verification course of applies to each financial institution assertion for UK visa submission, whatever the applicant’s nation of origin.

Your visa file is stronger whenever you add proof that backs up the stability you’ve gotten proven. You need to use:

- Payslips – the final three months, stamped by your employer

- Revenue-tax returns (ITR) – the final two years, with the acknowledgement sheet from the tax portal

- Mounted-deposit certificates – from a scheduled financial institution, displaying the quantity and maturity date

- Property valuation or title deed – to show long-term financial savings and ties to your own home nation

- Sponsor pack – a signed letter, the sponsor’s six-month financial institution statements, proof of relationship and replica of their UK passport or residence allow

If you happen to connect every doc to the financial institution statements, you’ll give the Entry Clearance Officer a full image of how the journey can be paid for. Understanding how a lot funds for UK Customer Visa it’s essential to present goes past simply the financial institution stability—it consists of all supporting monetary documentation.

The time period ‘funds parking’ means briefly putting a big sum of cash right into a checking account as a method of falsely demonstrating monetary stability. UKVI are extraordinarily alert to the usage of funds parking as a method of securing a Go to Visa. As an illustration, when you abruptly deposit £5,000 into your account with out clear proof of its origin, Entry Clearance Officers (ECOs) might deal with it as funds parking. If you happen to do have giant deposits in your financial institution statements, chances are you’ll want to offer proof explaining their supply, similar to a property sale or a bonus out of your employer.

Acceptable explanations and the paperwork you need to connect:

- Bonus or again pay: newest payslip plus employer letter stating the quantity and cause

- Property sale: completion assertion from the solicitor and a duplicate of the signed sale contract

- Reward from household: signed reward letter giving the donor’s identify, quantity and relationship, plus the donor’s financial institution assertion displaying the cash leaving their account

- Mortgage: a proper mortgage settlement and financial institution statements displaying the funds arriving from the lender

Present considered one of these paperwork, and the deposit can be accepted as real. Whether or not you’re figuring out the minimal financial institution stability for UK vacationer visa, keep away from funds parking to forestall automated refusal.

Listed below are another key factors to keep in mind to make sure you meet the monetary necessities for a UK Customer Visa:

- Printed on-line financial institution statements are completely positive so long as they embrace all mandatory particulars, such because the financial institution’s identify and handle, your private particulars, and your banking transactions.

- If you’re making use of from India, Pakistan or Nigeria, have your financial institution statements licensed by your financial institution. These nations sit within the high-refusal bracket and a stamp removes any doubt.

- If making use of from a rustic with excessive visa refusal charges, have your financial institution statements licensed by your financial institution.

- If you’re self-employed, be certain that all of your earnings is clearly proven in your financial institution statements. It is very important present a transparent sample of earnings and bills.

- Joint checking account statements are additionally positive if each account holders are making use of for UK Customer Visas collectively. If just one account holder is making use of, it have to be clear that the applicant has full entry to the funds.

Gathering the whole listing of paperwork required for UK Customer Visa consists of not solely financial institution statements but in addition proof of ties to your own home nation.

Self-Employed Guidelines:

- Newest tax return or tax computation

- Six months of enterprise financial institution statements

- Three latest buyer invoices that match the credit within the statements

Pakistani candidates typically ask how a lot financial institution assertion for UK Go to Visa from Pakistan they should submit, and the reply is 6 months of licensed statements displaying regular earnings.

The UK immigration guidelines require each applicant to show they’re a real customer. Our information on how you can show you’re a real customer underneath Appendix V explains what sort of proof, from journey intent to monetary stability, works greatest to strengthen your case.

Even a powerful financial institution stability could be ruined by a easy paperwork error. Under are the 5 quickest methods to ask a refusal, so you possibly can keep away from them.

Sudden deposits

A single giant credit score that seems a couple of days earlier than you apply seems to be like borrowed cash. If you happen to can’t present a payslip, sale deed or reward letter to match the quantity, the officer will deal with it as funds parking and refuse.

Inconsistent stability

Your stability swings from £200 to £4,000 and again once more. This sample suggests the cash isn’t genuinely yours or is simply short-term. Preserve the stability regular for the entire 28-day interval.

Unsupported sponsorship

Counting on a good friend or relative with out their stamped financial institution statements, proof of authorized standing within the UK and a signed letter is a routine refusal level.

Money-only financial savings

Displaying a wholesome stability however no wage credit, tax slips or enterprise invoices makes it onerous to show the cash got here from lawful exercise. All the time add at the very least three months of payslips or your newest tax return. A correct financial institution assertion for UK Go to Visa ought to clearly present the supply of your funds by means of common deposits.

Lacking pages or improper dates

Supplying solely 5 months of statements, or an announcement whose deadline sits exterior the 31-day window, is classed as incomplete proof and results in an automated reject. Assembly the UK Customer Visa financial institution assertion requirement means offering full, dated documentation that covers the total six-month interval.

Examine every level earlier than you press submit and you’ll current a file that’s simple to approve as a substitute of simple to refuse. Understanding the whole paperwork required for UK Customer Visa and getting ready them appropriately will considerably enhance your possibilities of approval.

Please Word: Visa refusals can typically be prevented when you perceive what the Dwelling Workplace seems to be for. Examine our detailed information on UK Customer Visa refusal causes in 2025 to find out about the commonest errors candidates make and how you can keep away from them.

- What are the monetary necessities for several types of UK Customer Visas in 2025?

If you happen to’re getting ready your proof of funds for a UK customer visa, the quantity you want depends upon your goal of journey , whether or not it’s for tourism, household visits, or enterprise conferences. Whereas the Dwelling Workplace doesn’t set a strict minimal, displaying satisfactory and constant funds strengthens your software.

Right here’s a fast comparability of the monetary necessities for UK customer visas in 2025:

| Visa Kind | Really helpful Funds | Key Supporting Paperwork |

| Vacationer Visa | £100/day + flights | Financial institution statements, journey itinerary, lodging proof |

| Household Go to Visa | £80/day + proof of relationship | Sponsor letter, household paperwork, invitation proof |

| Enterprise Go to Visa | £150/day + convention charges | Employer letter, enterprise or convention reserving affirmation |

- Can I exploit another person’s account for my UK Customer Visa proof of funds?

Sure, you possibly can, however provided that that individual is appearing as your official monetary sponsor. This might be a mum or dad, partner, or shut relative who’s protecting your journey and residing prices within the UK. You’ll want to offer their financial institution statements for the final six months and a signed sponsorship letter explaining your relationship and confirming they are going to fund your journey. With out this documentation, the Dwelling Workplace might not settle for third-party financial institution statements.

- Can I present fastened deposits or mutual funds for a UK Customer Visa?

Sure, you possibly can present fastened deposits (FDs) or mutual funds as a part of your proof of funds, offered they are often simply liquidated when wanted. Be sure to embrace official certificates or financial institution letters that clearly point out your identify, the financial institution or fund particulars, and the maturity dates. These paperwork assist the Dwelling Workplace confirm that the cash genuinely belongs to you and is available on your journey bills.

- How do I show monetary ties to my residence nation for a UK Go to Visa?

To exhibit sturdy monetary and private ties to your own home nation, which reassures the Dwelling Workplace that you simply’ll return after your go to, embrace paperwork similar to property possession papers, earnings tax returns, or employment affirmation letters out of your present employer. If you happen to personal a enterprise, you possibly can connect your enterprise registration certificates or financial institution statements displaying common exercise. The purpose is to point out that you’ve secure roots and commitments that make you prone to return residence.

- Can I present fastened deposit for UK customer visa?

Sure, you possibly can present a set deposit as proof of funds for a UK customer visa, offered it’s matured or could be liquidated on demand. The deposit ought to be in your identify (or your sponsor’s identify if relevant) and have to be supported by an official financial institution letter confirming the quantity, maturity date, and accessibility of funds. Mounted deposits which can be locked or inaccessible throughout your keep is probably not accepted as legitimate proof of funds.

Remaining Phrases

UKVI doesn’t present a minimal financial institution stability requirement for UK Go to Visa candidates. What issues is which you can present that you’ve sufficient cash to cowl your total keep. Offering clear, constant, and complete monetary proof by means of your financial institution statements is essential. Keep away from any indication of funds parking and be ready to offer detailed explanations for any giant deposits.

Each applicant’s monetary state of affairs is exclusive. Our immigration consultants at A Y & J Solicitors have dealt with over 200 Customer Visa instances and may help you put together sturdy financial institution stability proof and keep away from refusal. We’re proud to be ranked within the Authorized 500 and provide pleasant, clear recommendation tailor-made to your circumstances. In case you have any questions on your journey to the UK, please communicate to a member of our approachable workforce immediately.

A Y & J Solicitors is a specialist immigration regulation agency with intensive expertise in all varieties of visa functions. We now have an in-depth understanding of immigration regulation and are skilled and results-focused. For help together with your visa software or every other UK immigration regulation considerations, please contact us on +44 20 7404 7933 or contact us immediately. We’re right here to assist!